A recap from our The Inner Circle webinar with STL Partners on Sep 25 (public summary; full session is members-only available on the online community)

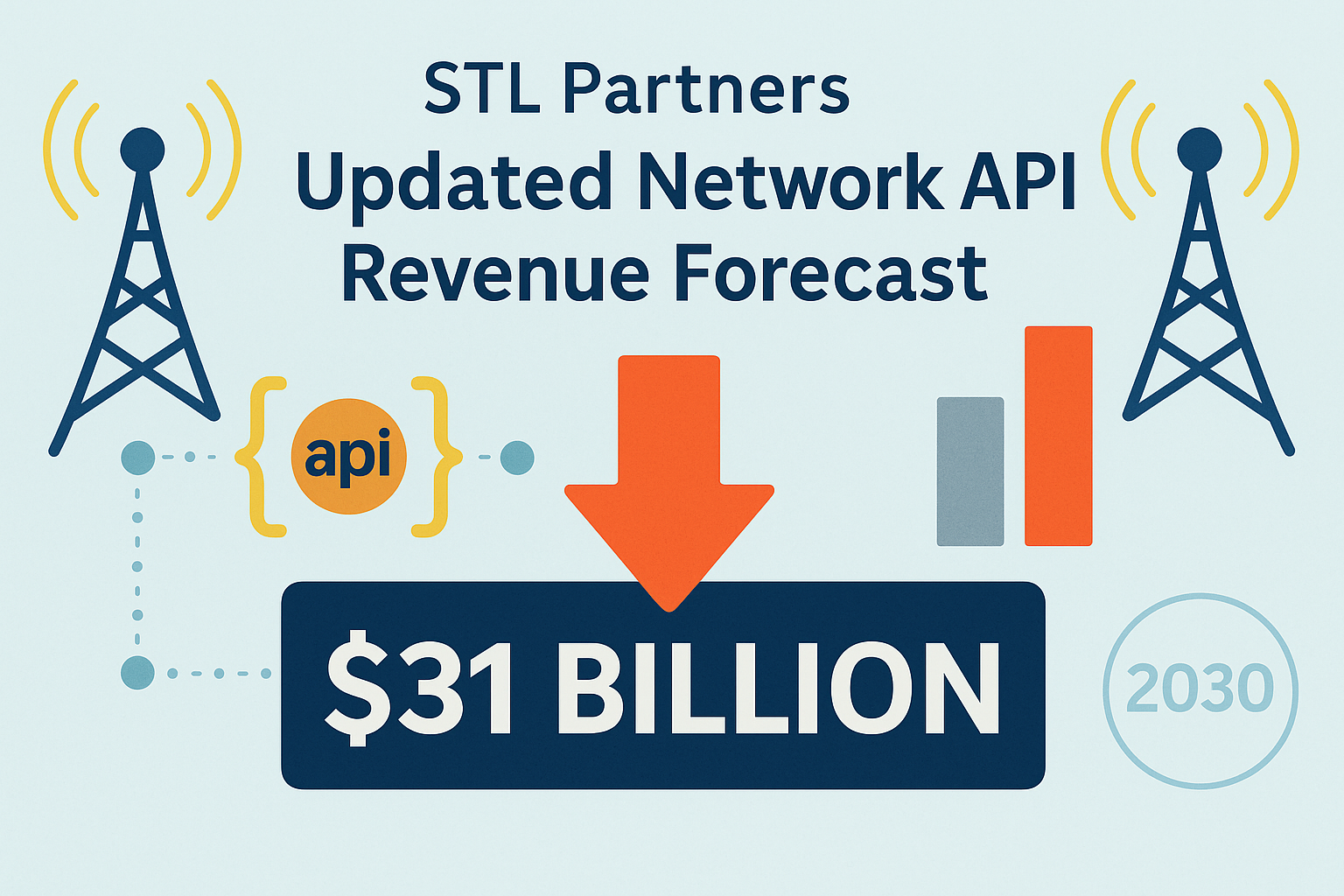

TL;DR: STL Partners still sees a large long-term opportunity for Network APIs, but the near term is slower than hoped. Other analysts peg 2030 at $8–12B; STL is higher (≈**$31B**) because they include more APIs, enablement revenue, and a use-case-led model. The gap isn’t just “telcos too slow”—it’s also awareness and product-market fit, especially with developers who don’t (yet) speak “Network APIs.”

What changed in STL’s update

STL trimmed early-year expectations but kept a bullish 2030 view. The main driver isn’t collapsing demand; it’s execution reality: legal/compliance work, platform exposure, standard alignment, and go-to-market motions take longer than slides imply. Even so, STL remains above the market consensus—our State of CPaaS 2025 explains why different methodologies land far apart.

Is this really a supply-side problem?

Partly—but not only.

- Supply frictions are real: uneven rollout, version fragmentation (different Camara versions), and varied legal interpretations slow federation.

- Demand isn’t turnkey: outside of CPaaS insiders, most developers don’t know (or care) what “Network APIs” are. They care about outcomes—fraud reduction, fewer OTP failures, better CX—not telecom taxonomy.

- Product packaging matters: APIs aren’t products; solutions are. When “network authentication” or “SIM-based fraud checks” are packaged into SDKs/workflows with clear ROI, adoption follows. When it’s just a spec, it stalls.

Where value shows up first

- Identity & anti-fraud: Number verification, SIM-swap checks, header enrichment–style signals—all familiar to CPaaS buyers—remain the on-ramp.

- Location (next wave, with caveats): Enterprise/IoT scenarios (fleet, asset tracking, industrial automation) avoid consumer-consent pitfalls and can move faster on single-customer/single-network footprints. But accuracy, pricing vs. GPS, and contracting still need work.

Standards vs. reality

Federation only works when interfaces match in practice, not just in principle. Expect a settling period toward stable versions—and, in parallel, a harmonization layer from aggregators/platforms to smooth the bumps. Both are needed.

What telcos and platforms can do now

- Ship outcomes, not acronyms: Lead with fraud loss reduction, conversion lift, or SLA improvements.

- Reduce integration cost: SDKs, reference apps, and drop-in workflows beat “read the spec.”

- Pick lanes: Start where you can control success—e.g., identity bundles with CPaaS partners, or enterprise/IoT location via your existing IoT/private-network channel.

- Stabilize versions: Prioritize a “boring” baseline over rapid version churn.

- Measure and market proof: Publish concrete case deltas (fewer OTP failures, faster onboarding, lower fraud).

Bottom line

The opportunity is real but earned. It’s not only that telcos must “move faster”; the ecosystem must speak the customer’s language and package capabilities so developers can adopt them without becoming telecom experts. That’s how we close the gap between the $8–12B consensus and the more ambitious scenarios.

Want the full debate, charts, and STL’s detailed cuts (by use case, revenue type, and region)? That’s in our members-only Inner Circle recording—and our State of CPaaS 2025 report unpacks why forecasts diverge and how Intelligent Engagement pulls this together.

👉 Join CPaaSAA to access the session, slides, and ongoing analyst briefings.

Comments are closed