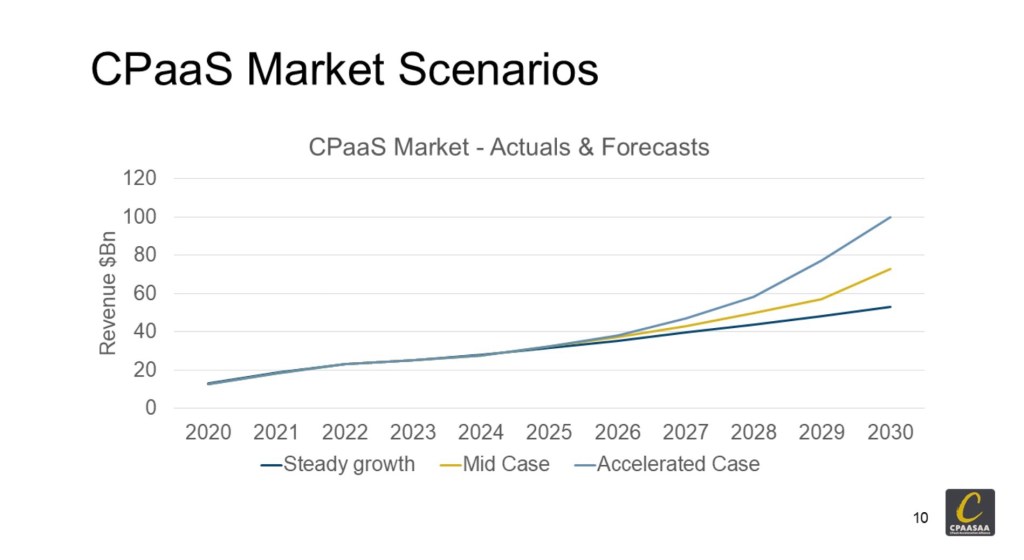

The Communications Platforms as a Service (CPaaS) market, worth $32bn in 2025, could grow 3x to as much as $100bn by 2030. The demand and supply side conditions are remarkably favourable, but the path to the fastest growthfuture is neither automatic nor guaranteed.

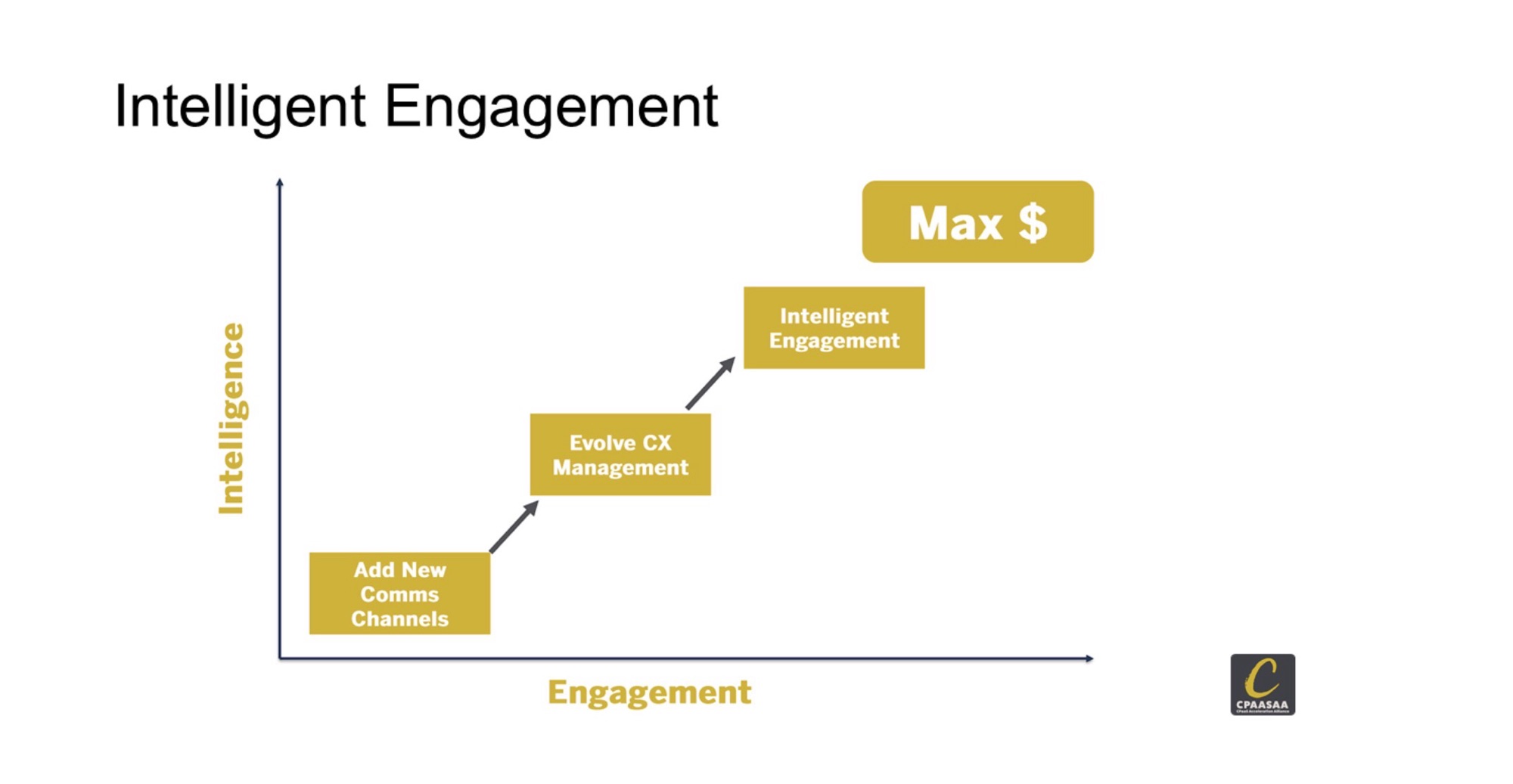

Growth will depend on how well the industry integrates AI, accelerates new engagement-enabling messaging channels like WhatsApp and RCS, and unlocks the potential of Network APIs. Above all, it will hinge on whether the industry can tell – and prove – a clear story of Intelligent Engagement.

New Report: The State of CPaaS 2025

The CPaaS Acceleration Alliance (CPaaSAA) new State of CPaaS 2025 report, sets out where the industry stands, where it could go, and with clear actions on what needs to happen next. It is CPaaSAA’s view, informed by discussions with our members, industry thought-leaders and key analyst partners. It can be downloaded in full here [LINK}.

Why this report matters

CPaaS has grown 25% CAGR in the last five years and matured significantly as a category. Yet the next stage of growth requires more than just delivering messages – it requires Intelligent Engagement: enterprises interacting with customers, partners, employees, and connected devices in near real time.

On the Enterprise side, we see clear evidence of this demand emerging, supported by over 100 case studies from CPaaSAA’s Case Directory and Service Provider Playbook.

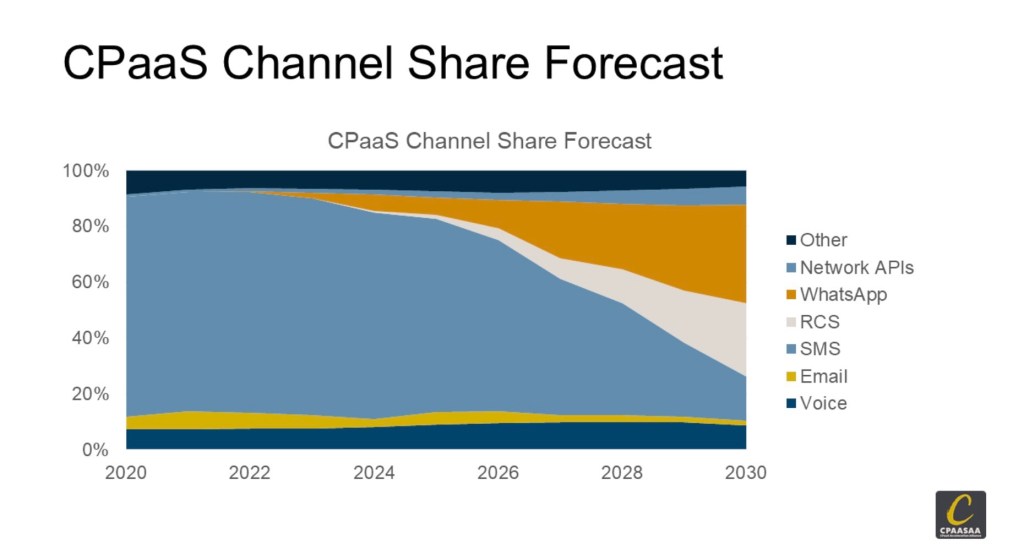

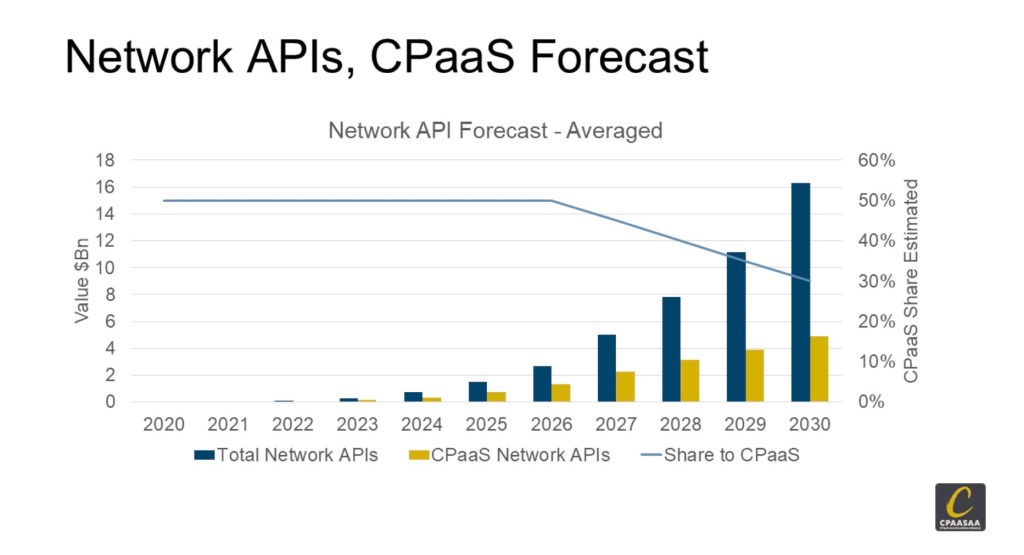

On the technology supply-side, it is made possible by the emergence of capable, affordable AI, new standards like vCons and GSMA Open Gateway network APIs, and programmable engagement-enabling communications channels, particularly WhatsApp and RCS.

What industry leaders need to do

The report highlights six actions to accelerate growth:

1. Promote the Intelligent Engagement narrative – a clear story that connects AI, messaging, voice, and APIs to real-world business outcomes. Industry players can accelerate the category by uniting on this clear, benefit led story.

2. Differentiate with and build new AI and data products that add proven vertical value beyond generic tools. The new vCon standard provides a great opportunity to add differentiation for Intelligent Engagement players.

3. Position RCS, WhatsApp, and SMS correctly – each has a distinct role, and enterprises need clarity.

4. Unlock Network APIs through partnerships and developer ecosystems.

5. Innovate in Voice – there are great opportunities to rebuild trust for voice communications, and AI transcription creates a treasure trove of data if it can be accessed in a compliant manner – which is where vCons come in.

6. Invest in trust and fraud reduction to strengthen adoption and reputation.

What’s in the report?

This report provides:

• Forecasts showing how the market could expand 1.7–3.1x by 2030.

• Case evidence from over 40 deployments, demonstrating measurable gains in efficiency, compliance, and customer outcomes.

• Recommended actions for providers, telcos, and partners to capture the opportunity.

Key findings

• Market trajectory: The CPaaS market could reach $55bn on a steady path, $73bn in a mid-case, or $100bn in an accelerated case by 2030.

• Channel shift: SMS still dominates today (70% of revenue), but by 2030, WhatsApp and RCS are forecast to account for over 60%.

• AI as enabler: Case studies show AI is already delivering results – chatbots, transcription, translation, fraud prevention – but its maximum value comes from deep integration with CPaaS and vCon capabilities.

• Network APIs: Anti-fraud, ID, and verification APIs from the GSMA Open Gateway initiative represent a $5bn CPaaS opportunity by 2030.

• Voice revalued: Once written off, voice is regaining strategic relevance through transcription, analytics, compliance, and new standards such as vCons.

What readers gain

For providers, telcos, investors, and enterprises, this report is designed to be practical. You’ll find:

• Benchmark data on the scale and speed of the market.

• Clear explanations of technology drivers and the business opportunities without jargon.

• Evidence of proven benefits from early adopters.

• Strategic guidance on where to focus investment and partnership.

It is written to be read in two ways: a skim-and-dip executive overview with headlines and actions, and a deep-dive narrative for those who want full detail.

In conclusion

The CPaaS industry stands on the edge of a new chapter. Growth to $100bn is within reach – but only if the industry unites around Intelligent Engagement, proves its value, and acts decisively.

👉 Download the full State of CPaaS 2025 report [LINK} to see the detail, evidence, and recommendations.

Andrew Collinson

Andrew Collinson is a telecoms and connected technologies expert, specializing in growth strategy, research, and thought leadership. As founder of Connective Insights, he helps clients translate new technologies into viable business models, with a focus on CPaaS, APIs, platform strategies, AI, and network automation.

Before joining CPaaSAA as Associate Research Partner, Andrew was Research and Commercial Director at STL Partners for 15 years, leading a successful research business. He also moderates events, conducts bespoke research, and advises on telecom innovation, stakeholder dynamics, and digital transformation.

Comments are closed